Net profit percentage formula

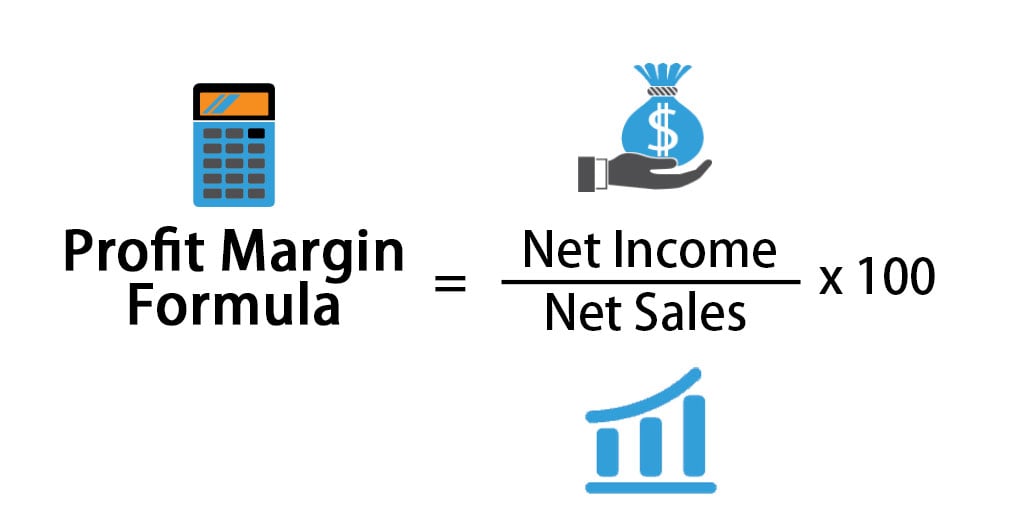

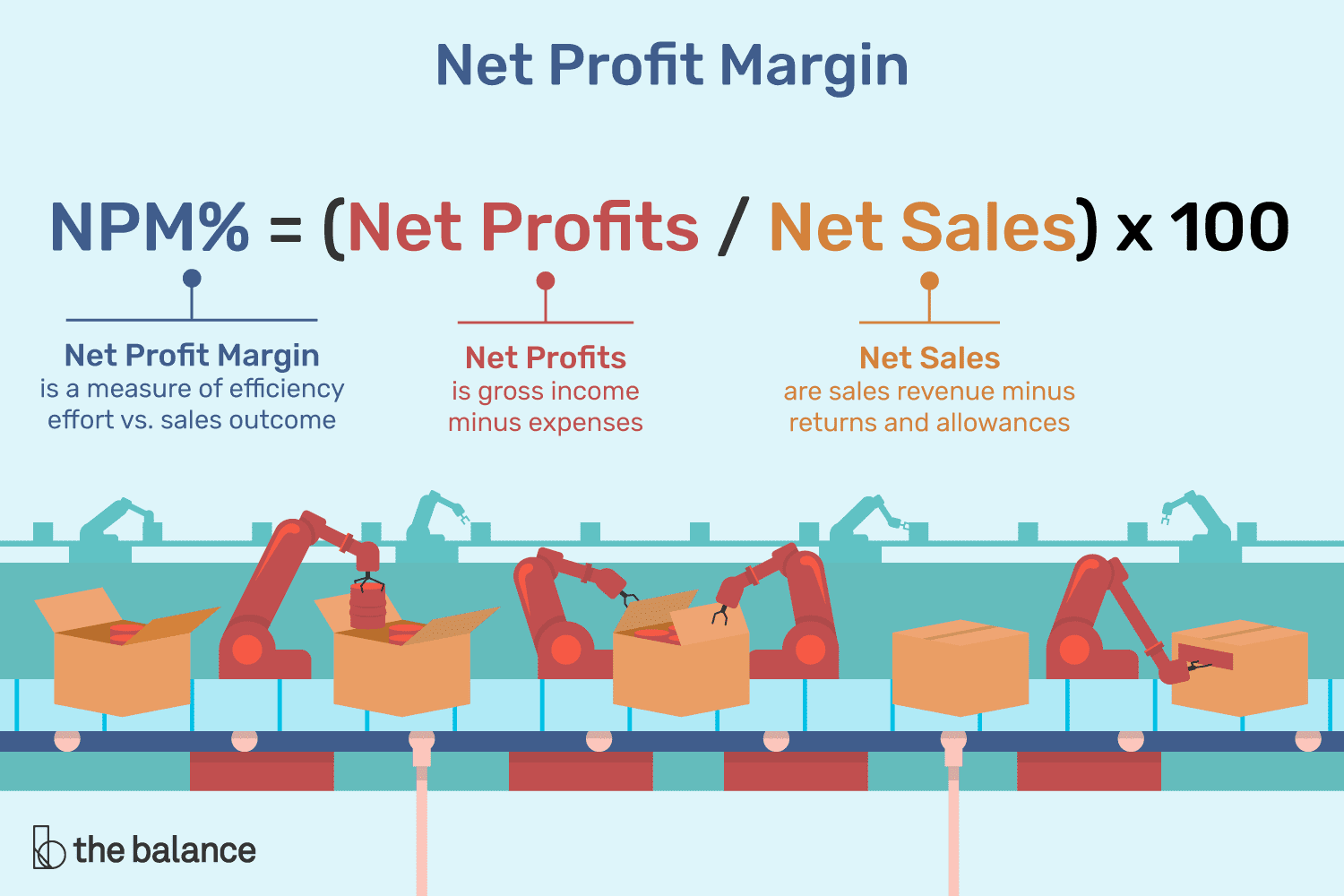

Net profit is calculated by deducting all company expenses from its total revenue. It shows how the revenues are converted into net income or net profit.

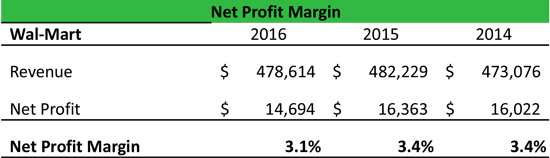

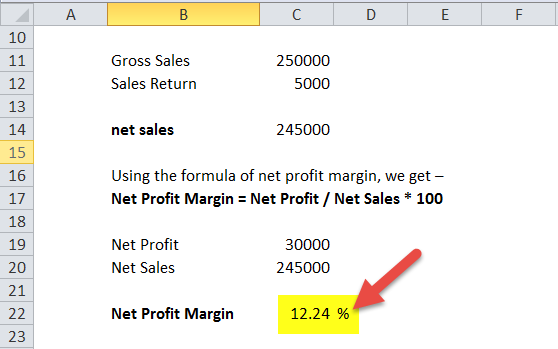

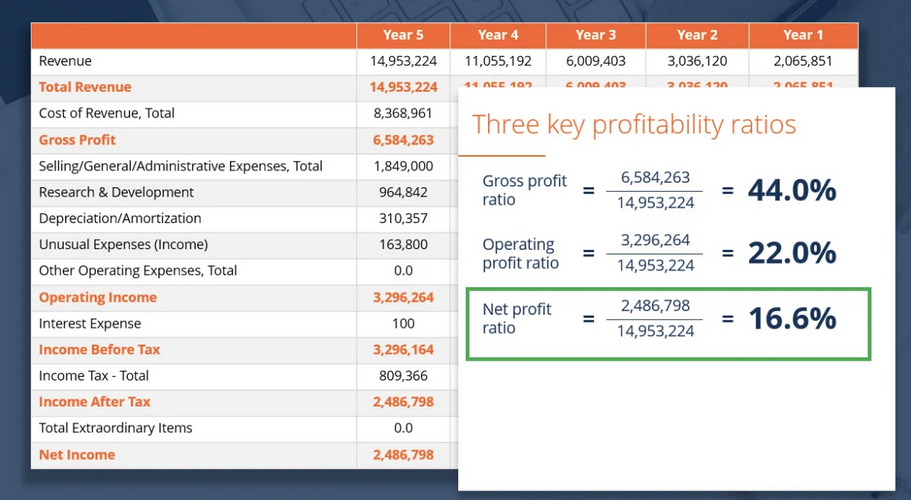

Net Profit Margin Formula Example Calculation

Using the Profit Percentage Formula Profit Percentage ProfitCost Price 100.

. Ie 20 means the firm has generated a. With our money back guarantee our customers have the right to request and get a refund at any stage of their order in case something goes wrong. Current assets can be Cash Sundry debtors Inventory Accounts receivables etc.

The formula of net profit margin can be written as follows. Relevance and Use of Profit Percentage Formula. Profit percentage is a top-level and the most common tool to measure the profitability of a business.

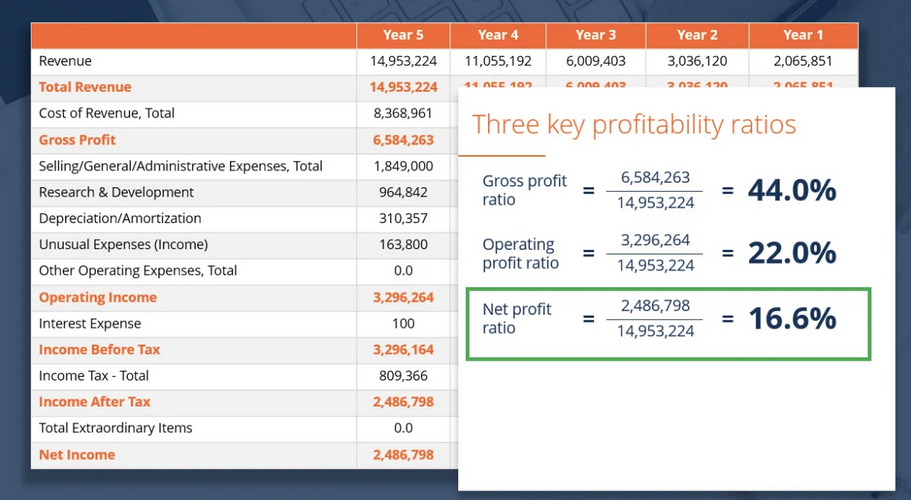

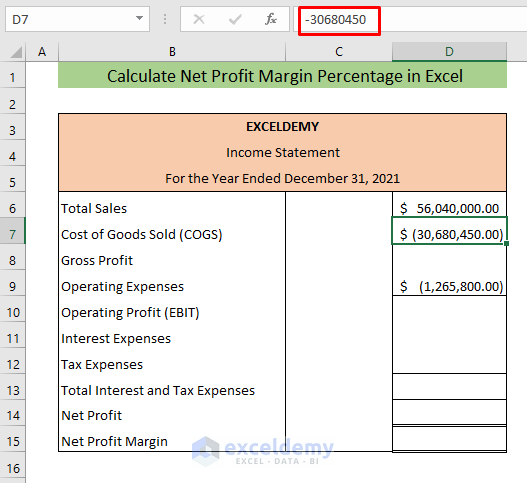

More simply the net profit margin turns the net profit or bottom line into a percentage. Gross profit percentage formula Total sales Cost of goods sold Total sales 100. Net profit is the amount of money your business earns after deducting all operating interest and tax expenses over a given period of time.

Calculate the cost price of the table. Net margin is a ratio that is typically expressed as a percentage though it may also be listed in decimal form. To calculate the percentage ROI we take the net profit.

Calculation of percentage change in a profit can be done as follows- 175500-294944 175500 100. It is the percentage of selling price that is turned into profit whereas profit percentage or markup is the percentage of cost price that one gets as profit on top of cost priceWhile selling something one should know what percentage of profit one will get on a particular investment so. Net Change Formula Current Periods Closing Price Previous Periods Closing Price read more.

It measures the ability of the firm to convert sales into profits. On selling a table for 840 a trader makes a profit of 130. 25 from each watch with a profit percentage of 125.

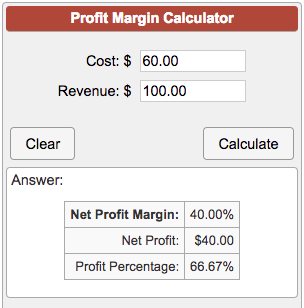

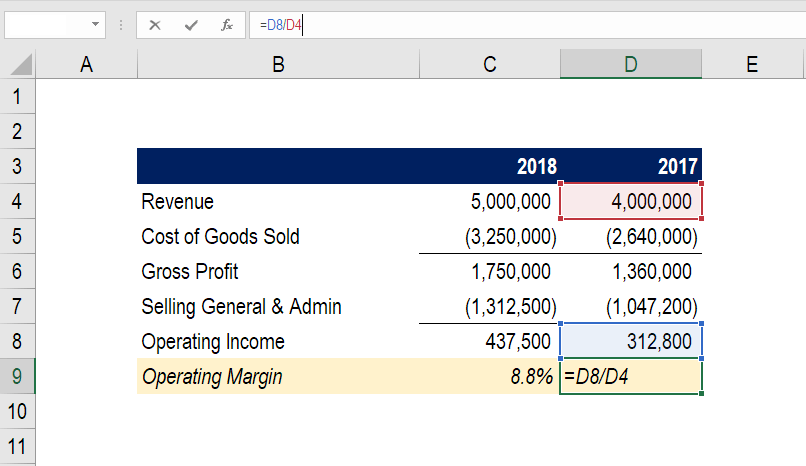

It can be said that the shopkeeper made a profit of Rs. In other words given a price of 500 and a cost of 400 we want to return a profit margin of 20. The goal is to calculate and display profit margin as a percentage for each of the items shown in the table.

Net Profit Margin Formula. The following data has been extracted from income statement of Zain Maria corporation. The first component of the Net Working Capital formula is Current assets.

In the example shown the formula in E5 copied down is. Divide this result by the total revenue to calculate the net profit margin in Excel. CP SP 100 100 percentage profit.

Formula to calculate cost price if selling price and loss percentage are given. Why Net Profit Margin Is Important. So the profit percentage of the shopkeeper will be 25 20 100 125 100 125.

Net income or net profit may be determined by subtracting all of a companys. After covering the cost of goods sold the remaining money is used to service other operating expenses like sellingcommission expenses general and administrative expenses Administrative Expenses Administrative expenses are indirect costs incurred by a business that are not directly related. Relevance and Uses of Percentage Change Formula.

Net profit margin is the ratio of net profits to revenues for a company or business segment. Decrease Percentage Formula Decrease Percentage Formula Decrease Percentage is used to determine. Profit margin is calculated with selling price or revenue taken as base times 100.

Gross Profit Margin Formula Net Sales-Cost of Raw Materials Net Sales Gross Profit Margin 100000- 35000 100000. The result of the profit margin calculation is a percentage for example a 10 profit margin means for each 1 of revenue the company earns 010 in net profit. The relationship between net profit and net sales may also be expressed in percentage form.

Therefore the profit earned in the deal is of 5 and the profit percentage is 20. Is a relative number a percentage which is equal to the ratio between profit and revenue. Using the above formula Company XYZs net profit margin would be 30000 100000 30.

Gross Profit Percentage 3000000 650000 3000000 100. On the Home tab in the Number group click the percentage symbol to apply a Percentage format. Profit Percentage 525 100 20.

Gross Profit Percentage 7833 So Networking Inc is getting 7833 gross profit on bags which tells networking Inc that 7833 of its net sales will become gross profit and for every dollar of sales networking Inc generates they earn 7833 in profit before expenses are paid. Profit Percentage fracProfittextCost Price x 100. Percentage Change New Value Original Value Original Value 100.

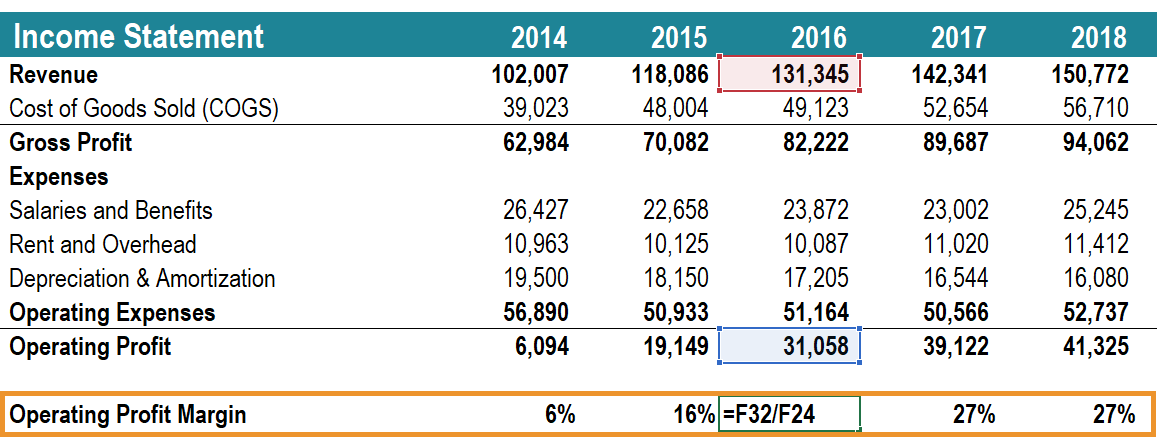

Profit margin is a profitability ratios calculated as net income divided by revenue or net profits divided by sales. The income statements aim is to show managers and investors whether the business made money profit or lost money loss during the time span under. A 35 net profit margin means your business has a net income of 035 for each dollar of sales.

Calculate Percentage Increase in. So basically it is the additional money over and above the cost of. There are two main reasons why net profit margin is useful.

Each item in the table has different price and cost so the profit varies across items. The formula of profit percentage is given as follows. For example an investor.

In this example the goal is to calculate and display profit margin as a percentage for each of the items shown in the table. Net Profit Margin Formula. Current assets are referred to the assets that can be converted into cash within a years time period.

Finally the percentage change formula can be expressed as the change increase or decrease in value step 3 divided by its original value step 1 which is then multiplied by 100 as shown below. Formula to calculate cost price if selling price and profit percentage are given. The Net Working Capital formula can be broken down into two components.

Net margin also called net profit margin measures how much profit or net income is earned as a percentage of overall revenue. Net Profit margin Net Profit Total revenue x 100. Investors are typically interested in gross profit margins as a percentage because this shows them to compare margins between peer companies no matter their sales volume or size.

CP SP 100 100. Using the formula for profit percentage Profit Profit CP 100. Profitability is a measure of efficiency and it is useful in determining the success or failure of a business.

Using the net margin formula we divide the 30000 net profit by the 100000 total revenue to. In other words given a. ARR is a formula that measures the net profit or return expected on an investment compared to the initial cost.

Markup Percentage Formula Markup in very simple terms is basically the difference between the selling price per unit of the product and the cost per unit associated in making that product. To calculate the percentage discount from an original price and a sale price you can use a formula that divides the difference by the original price. Typically expressed as a percentage net profit margins show how much of each dollar collected by a.

When it is shown in percentage form it is known as net profit margin.

Net Profit Margin Prepnuggets

Operating Profit Margin Learn To Calculate Operating Profit Margin

How To Calculate Net Profit Margin Percentage In Excel Exceldemy

Operating Profit Margin Formula Meaning Example And Interpretation

Net Profit Margin Formula And Ratio Calculator Excel Template

Net Profit Margin Formula And Ratio Calculator Excel Template

Profit Margin Calculator

/dotdash_Final_Gross_Margin_vs_Net_Margin_Whats_the_Difference_Nov_2020-01-de889f0261d2482780bda560dc14a6ce.jpg)

How Does Gross Margin And Net Margin Differ

Profit Margin Formula Calculator Examples With Excel Template

Net Profit Margin Definition Formula How To Calculate

What Is Net Sales A Complete Guide With Formula Examples

Net Profit Ratio Double Entry Bookkeeping

Guide To Profit Margin How To Calculate Profit Margins With Examples

Operating Margin An Important Measure Of Profitability For A Business

Profit Percentage Formula Examples With Excel Template

Operating Profit Margin Formula Calculator Excel Template

Net Profit Margin Definition Formula How To Calculate